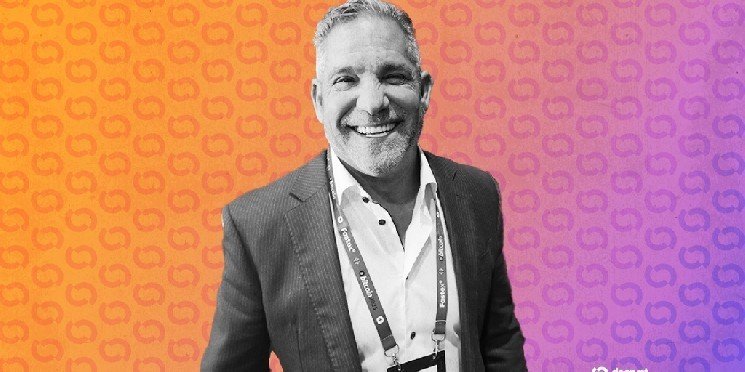

Investors may see opportunity in gold’s historic rally, but they shouldn’t sell Bitcoin According to real estate investor and entrepreneur Grant Cardone, this is to get a firm grip on precious metals.

Although the price of gold has risen more than 50% this year, outpacing Wall Street favorites like Nvidia, the largest cryptocurrency by market capitalization remains a good store of value and has a better long-term outlook, he said. decryption In an interview.

“Don’t say anything stupid,” Cardone said Wednesday. “I’m not going to chase this right now. Every time I sell a Bitcoin, I’m going to lose $1 million.”

Cardon’s assessment comes as investors begin piling into alternative assets as a way to protect against a potential downturn in the U.S. economy and the resulting decline in the U.S. dollar. derogatory trade.

On Wednesday, gold prices crossed the $4,000 per ounce level for the first time. Bitcoin price decided the day before best ever $126,000, according to crypto data provider Colling gecko.

Myriad Markets found that 60% of respondents think Bitcoin is more likely to rise to $140,000 than fall to $110,000. Myriad is part of Dastan, the editorially independent company’s parent company. decryption.

Bitcoin’s price may be more volatile than gold right now, but Cardone believes technological innovation will dull the precious metal’s shine in the coming years. He said automation could have a negative impact on gold scarcity, pointing to the reduced labor costs inherent in robots.

“If Elon’s Optimus works, he will be able to drill 24/7 without being paid,” he said, referring to the billionaire tech CEO’s push to develop robots at electric car maker Tesla. “The amount of gold we mine is limited by the number of people who can mine it.”

This is clearly different compared to Bitcoin, which has a total supply of 21 million coins, or real estate, which faces geographic constraints, he added. prediction suggest Based on the network’s current rules, 2093 will be the year in which the penultimate Bitcoin will be mined.

Investors may seek out exchange-traded funds backed by gold, but they are effectively investing in paper, Cardon argued. For them to truly own gold. Mr Cardone said he had to manage the management of his assets while running the risk of them being stolen.

The same principle applies to investors who hold Bitcoin in self-custodial wallets. But Cardon pointed out that Bitcoin does not require physical storage and is easy to use.

While Cardone may prefer Bitcoin over gold, other entrepreneurs, including star hedge fund investor Ray Dalio, advocate a combination of both. He said this in late July, when gold prices were trading around $3,300 an ounce. prompted Investors allocate 15% of their portfolio to them.

He said at the time that rising government debt was not priced into global markets and that he had a “strong preference” for gold. Last month he echoed He said if the government doesn’t curb its spending habits, the United States risks suffering a “debt-induced heart attack.”

The Bridgewater Associates founder argued that central banks are unlikely to adopt Bitcoin as a reserve currency because of its lack of privacy. He also raised questions about whether changes to Bitcoin’s codebase could make Bitcoin’s store of value “less effective.”

This week, investment company VanEck Estimation Bitcoin has the potential to capture half of gold’s $26 trillion market cap, but that could take years. Bitcoin is currently worth $2.4 trillion, compared to $1.2 trillion a year ago.

This year, Cardon It started It mixes real estate and Bitcoin in funds offered to accredited investors through Cardone Capital, which manages a $5 billion portfolio. When a tenant living in a commercial property pays rent, the funds are allocated to Bitcoin over time.

Still, Cardone said he has encouraged some curious Bitcoiners to sit back and watch.

“Some people came up to me and said, ‘I’d like to invest Bitcoin in your project,’ and I thought, ‘Why would you do that?'” he said. “Why not just keep the Bitcoin and redeem some of the cash? I don’t see why someone would get rid of that asset.”