Bitcoin rose to the bottom on Monday after Moody’s rating downgraded the US sovereign credit rating after a major shift in investor sentiment.

The credit rating agency reduced the long-standing US “AAA” rating to “AA1,” citing rising fiscal pressure due to $36 trillion citizen debt and increased interest. The decision marked Moody’s first US downgrade since 1919 assigning a century-long highest ranking rating.

The timing of the downgrade coincided with Bitcoin pullbacks from the four-month peak. After hitting an overnight high of $107,060 and a strongest weekly end of nearly $106,500, Crypto fell to $102,200 during the session.

Over the past 24 hours, Bitcoin’s value has dropped by 1.29%, wiping out weekly profits. The retreat responded to increasing financial uncertainty by reducing investors’ exposure to speculative assets and highlighted a shift in risk appetite.

However, in response to downgrades, White House spokesman KushDesai It was criticized Moody’s reliability refers to perceived omissions during previous management.

Meanwhile, Treasury Secretary Scott Bescent downplayed the immediate impact of the decision, calling it a “lag indicator” that has a minimal impact on financial planning.

Breaking:

trump Trump is opposed to Moody’s decision to downgrade US credit ratings. pic.twitter.com/nlly9vm57t

– Marzell (@marzellcrypto) May 19, 2025

The activity of derivatives indicates increased volatility

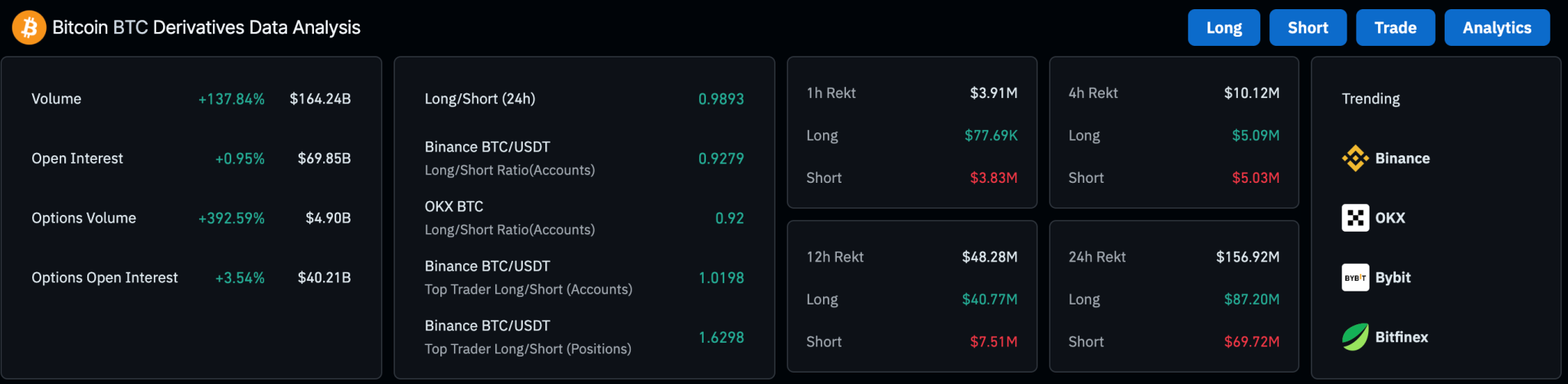

Amid the wider market response, the Bitcoin derivative market experienced a significant surge in activity. Trading volume increased by 137.84% to $16.424 billion, indicating an increase in speculative profits. Nevertheless, open interest increased by just 0.95% to $69.85 billion, suggesting a rapid position departure rather than a long-term commitment.

Bitcoin derivative data

The liquidation data highlighted this volatility. Beyond the 12-hour window, the total liquidation reached $48.28 million, with the long position accounting for $40.77 million. Over the course of 24 hours, a total of $156.92 million was liquidated, with a long $872 million and a $6,972 million shorts.

Will there be more volatility?

The Moody’s downgrade follows a similar action with the 2023 Fitch rating and the Standard & Poor’s rating in 2011. Analyst It’s attracting attention That the cumulative effects of these downgrades could contribute to increased borrowing costs for both the public and private sectors of the United States. This could lead to greater volatility in financial markets.

Spencer Hakimian of Tolou Capital Management reported that downgrades could lead to long-term financial burdens across the market, and could raise capital costs.

The development temporarily disrupts the rally to Bitcoin’s all-time high, but commentators in the Crypto industry have been almost surprised by the short-term pullback. In particular, the launch of the “Altcoin Season” and the ongoing Bitcoin Rally forecast by influential figures such as Arthur Hayes have been updated to $250,000.

Interestingly, MicroStrategy’s Michael Saylor also revealed today the acquisition of millions of dollars of fresh Bitcoin. This continues to institutional trust in assets despite macroeconomic headwinds.