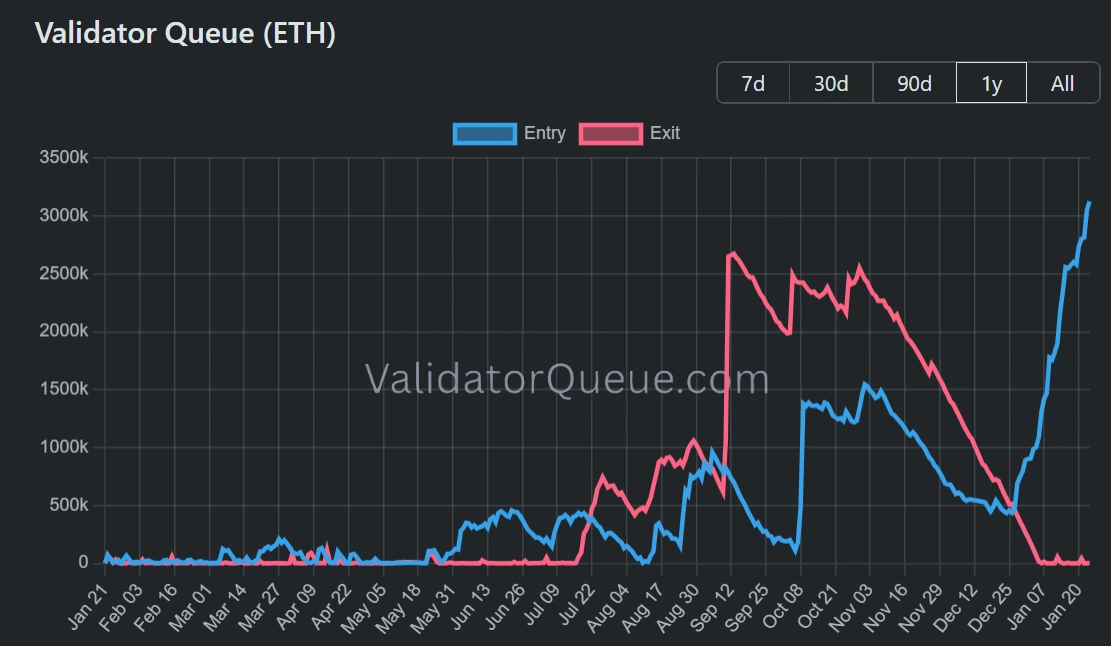

Entry queue to become an Ethereum validator is currently 3,114,842 Ethereum The wait time was 54 days and two hours, according to Validator Queue data, making it the longest entry queue in more than a year as institutional investors pour money into the world’s second-largest cryptocurrency network.

The last time exit lines were dominant was in December 2025, after peaking in September.

976,509 active validators have staked over 36.3 million Ethereumwhich accounts for almost 30% of the total supply at the time of this writing.

Source: Validator Queue

Why is the Ethereum validator entry queue crowded?

The increase in entry queues was primarily driven by institutional investors acquiring major positions in Ethereum staking.

As of January 19, 2026, Tom Lee’s Bitmine, a leading Ethereum finance company, held a stake. 1,838,003 Ethereumvalued at $5.9 billion at $3,211 each. Ethereum.

BitMine currently holds over 4.2 million Ethereumwhich is almost 3.5%. EthereumTotal circulating supply of.

Lee, Chairman of BitMine, said: Ethereum than any other being in the world. At scale (Bitmine) Ethereum Fully funded by MAVAN and its stake partners), Ethereum Staking fees amount to $374 million per year (using 2.81% CESR), or over $1 million per day. ”

73.57% gray scale Ethereum Collection items At the time of writing, the bet is on. The asset manager will then become the first U.S. Ethereum-listed product to distribute staking rewards to investors in January 2026, with Purpose Investments set to follow suit on January 30th.

SharpLink Gaming, which operates under the ticker SBET, has emerged as the first publicly traded company to use SBET. Ethereum as a major treasury asset. The company created Over 11,600 Ethereum Since launching Ethereum Treasury in June 2025, we have been freed from staking activities.

Technical upgrades have reduced barriers to entry

ethereum pectra upgrade In May 2025, we helped lower the barrier to large-scale staking operations. Update increases maximum stake for validators from 32 Ethereum up to 2,048 Ethereum In addition, automatic compounding of rewards is now possible. This makes it easier for institutional investors to manage large positions without having to deal with thousands of individual validators.

and 29.88% Ethereumsupply of Currently locked into staking contracts and with a current annualized rate of 2.83%, the network is facing a tight liquid supply. Analysts have suggested this could support price growth, with some predicting it heading towards $4,000 to $6,000 in 2026.

Critics argue that the concentration of staking power among institutional investors threatens the decentralization that is at the core of Ethereum.

But people like Lee disagree with this view because they believe that someone who makes up 10% of the system does not control it. BitMine management says it wants to acquire more companies Ethereum And we will increase the holding percentage to 5% of the token supply.