Bitcoin has been trading near the ATH of its all-time high (ATH) for the past two months, exceeding $100,000. However, spot trading volumes are not compatible. Unlike previous Bull Runs, this price level has not caused a surge in trading activity.

This difference has sparked concern among investors. Recent analyses from Cryptoquant, GlassNode, and other market data sources provide important insights into this extraordinary trend.

Bitcoin prices are detached from spot volume – what does that mean?

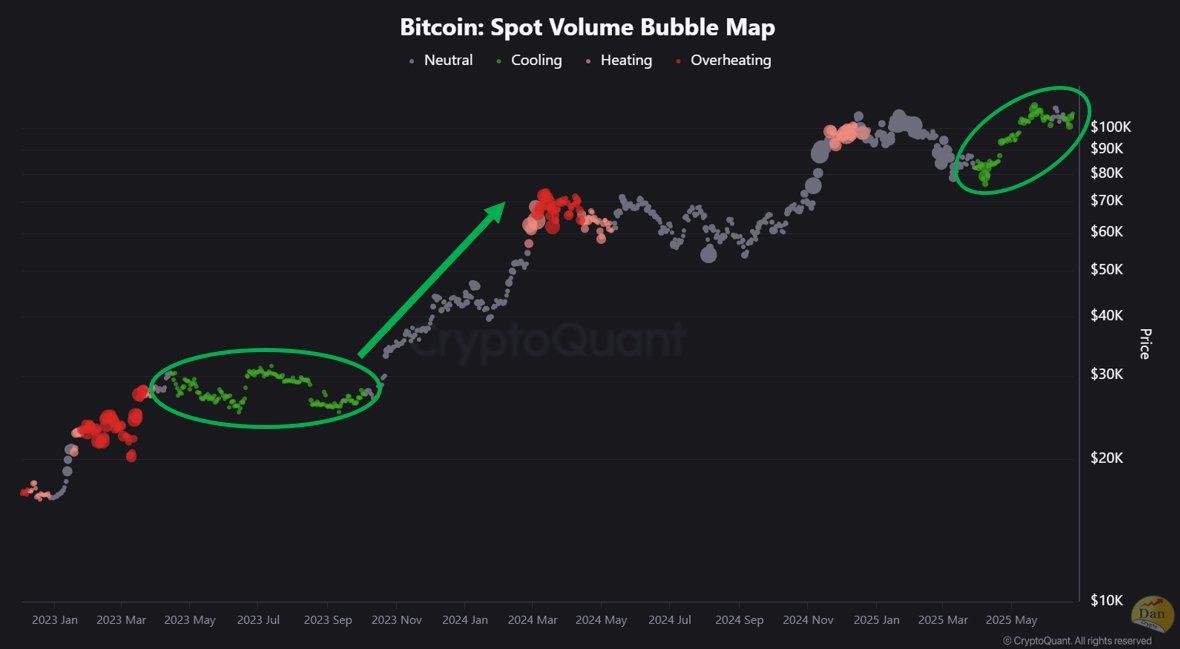

According to Dan of Cryptoquant, the market is currently in the “cooling” stage with no signs of overheating.

Bitcoin spot volume bubble map. Source: Cryptoquant.

The chart shows that the size of each yen represents the volume of trade, while the color indicates the growth rate of that volume. The decline in volume indicates the cooling market. The neutral market does not show a sudden change, and rapid increases in volumes can indicate overheating.

Now, even as Bitcoin approaches ATH, a green circle that represents cooling controls the chart. This suggests a lack of speculative frenzy. Dan emphasized that he wanted patience at this stage.

“Bitcoin is at its all-time high right now, but the market has shown a cooling trend with no signs of overheating. The market may already have a stable foundation to break down the greatest macroeconomic catalysts of all time, such as interest rate cuts and restrictions relaxation.

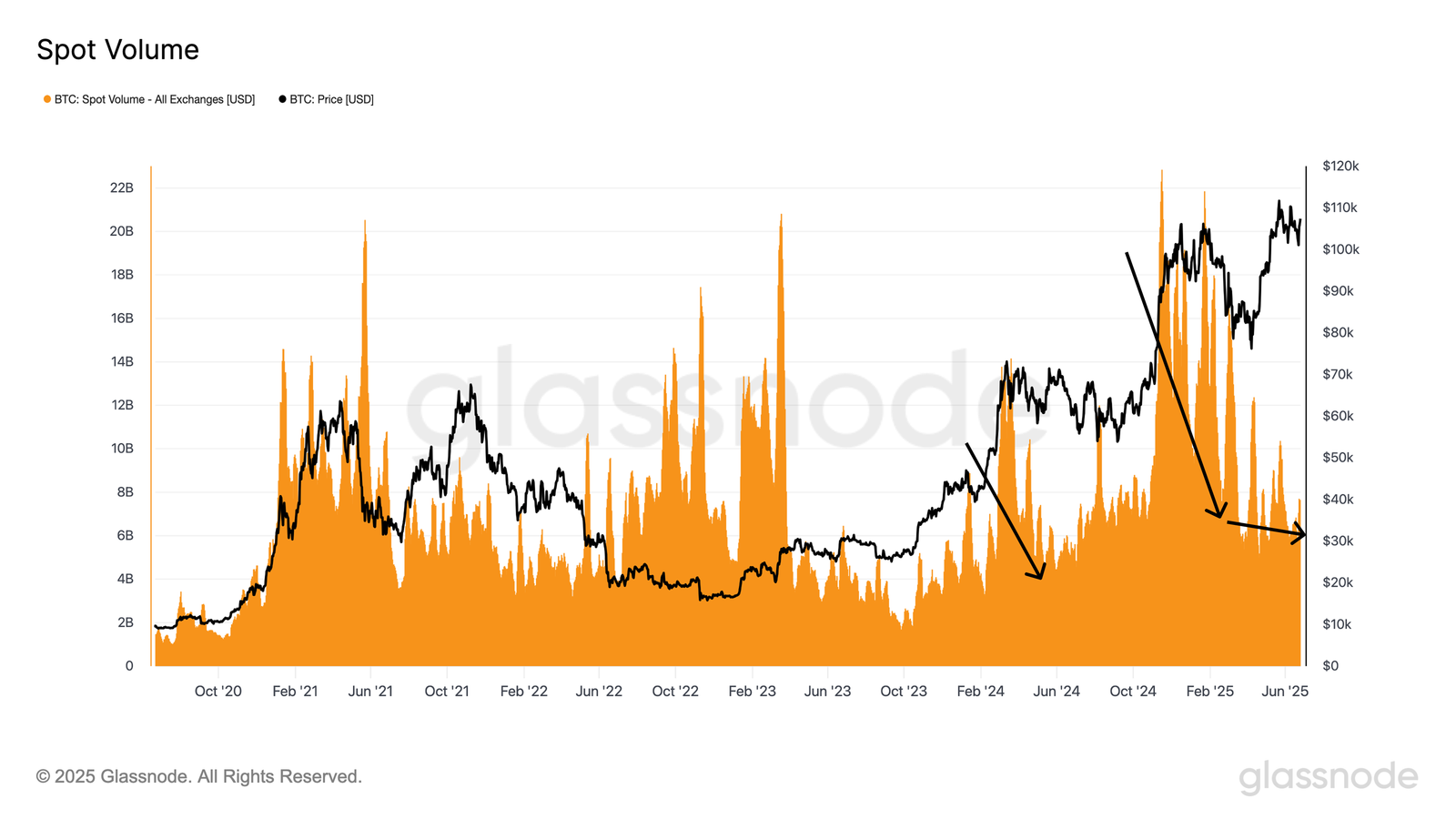

Additionally, GlassNode’s Week 25 report reflects Cryptoquant’s rating. Unlike the ATH rallies in the second and fourth quarters of 2024, it noted that the recent cap above $100,000 was not accompanied by a corresponding rise in spot volume.

This reflects the lack of guessing strength. This is an important feature that is common in previous bull runs.

Bitcoin spot volume for all exchanges. Source: GlassNode.

Instead, GlassNode suggests that accumulation strategies are likely to drive current price increases. It appears that long-term investors are holding Bitcoin instead of selling for profit.

“The current spot volume is $7.7 billion, significantly lower than the cyclical peak observed in this bull market. This divergence further highlights the lack of speculative intensity, highlights market hesitation and strengthens the narrative of integration,” the report states.

Reducing liquid supply added to the puzzle

Another important factor is the decline in Bitcoin’s liquid supply.

According to data from GlassNode and other sources, only about 25% of total Bitcoin supply remains liquid. The remaining 75% is held by illiquid entities. Typically a long-term holder or institution that has no intention of selling.

Non-liquid supply of Bitcoin. Source: GlassNode.

“The illiquid supply of Bitcoin continues to climb and is always at its best. Only 25% of Bitcoin supply remains “liquid.” Supply shock will be cruel! ” said Nic, co-founder of the Coin Bureau.

This creates a potential supply crisis. With fewer coins available in the market, prices can be increased even when demand is slow. This helps explain why Bitcoin remains close to ATH levels without rushing to spot trading volume.

A drop in spot volume could indicate a lack of retail investors FOMOs that promoted the previous bull cycle. Instead, it could indicate a shift towards long-term value investments in short-term speculation.

Still, without macroeconomic catalysts like interest rate reductions and technical breakthroughs, Bitcoin prices could stagnate to boost market confidence.