Bitcoin analysts and enthusiasts meticulously analyse every price movement, pursuing tips on the next direction, exceeding the $100,000 threshold for over a week. Meanwhile, the forecast market allocates a significant chance that Bitcoin will remain in six-digit status by the end of the year.

Predictive market frenzy

Forecast markets such as Polymarket, a decentralized blockchain-based platform, and Kalshi, a regulated US market, have become the go-to destinations for the past year to predict future outcomes.

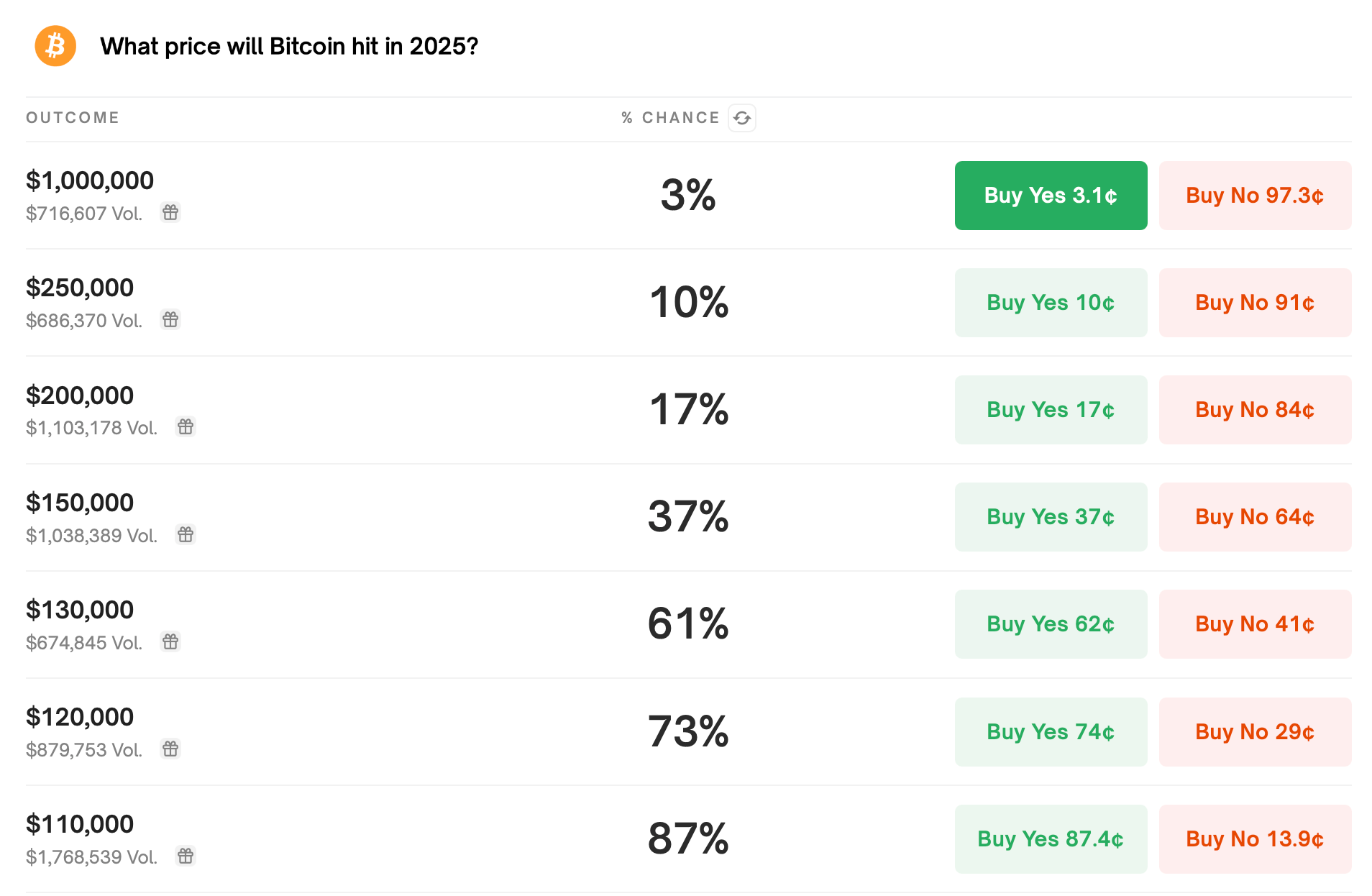

Among the forecasts this year is Bitcoin ratings, with Polymarket participants predicting BTC to exceed $100,000 at the end of the year. In fact, with a trading volume of $9.51 million, participants assign 87% of the chances that Bitcoin will enter a bracket of $110,000.

Source: Polymarket

The bet will allocate a 73% chance that BTC will violate $120,000, with a 61% chance of testing $130,000 by December 31, 2025, with 37% of participants in the Polymerket Market able to achieve $150,000, and 17% will bet at $200,000.

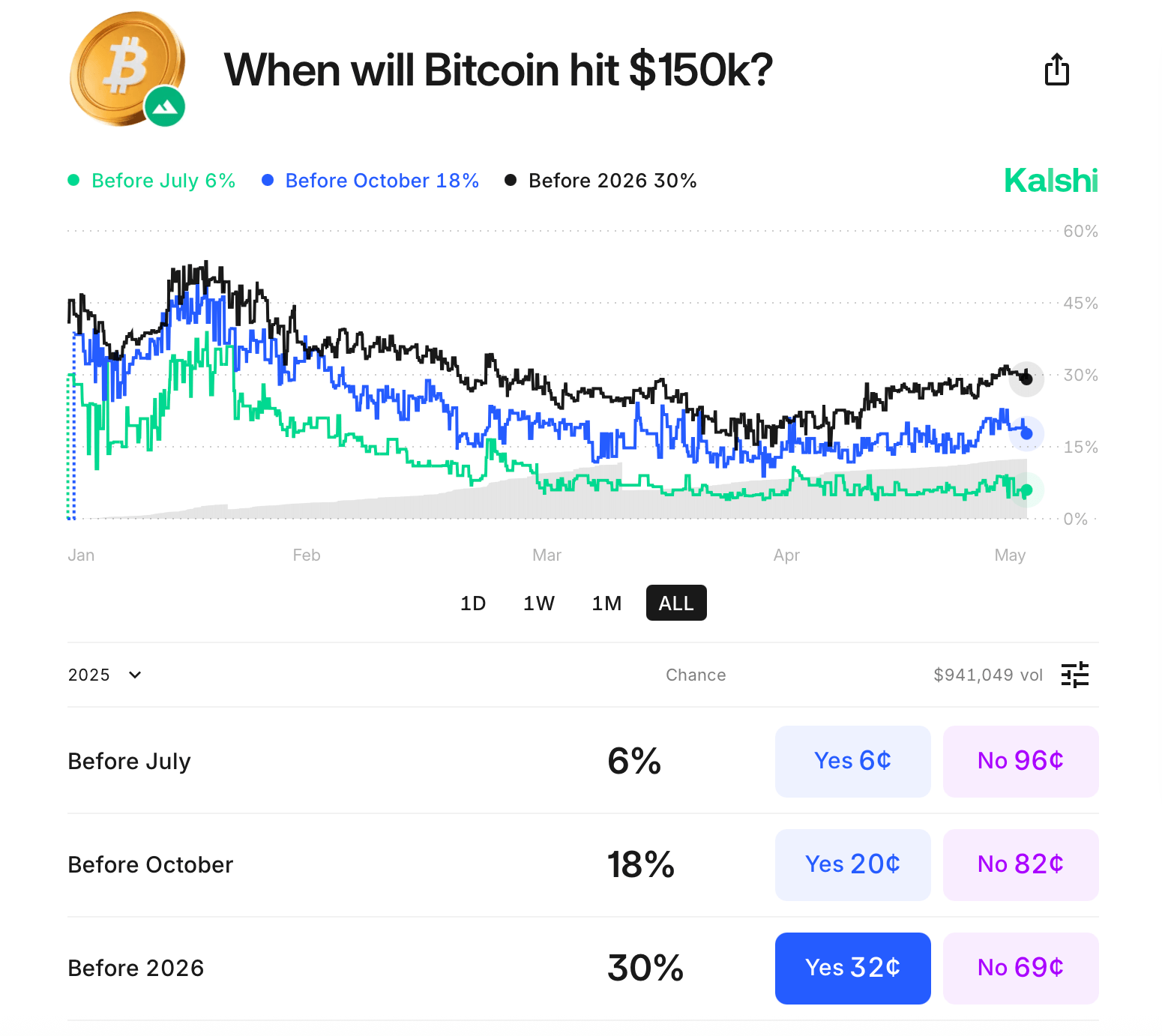

The $250,000 threshold has a 10% chance, and a brave 3% bet assumes BTC will reach seven figures. Meanwhile, 38% expect Bitcoin trading to be nearly $70,000, while 17% expect a $50,000 slide. Interestingly, 5% of bettors expect BTC to sink to $20,000 by the end of the year. The bet on calci asks, “When did Bitcoin reach $150k?” And there’s a 30% chance that it will happen before 2026.

Source: Kalshi

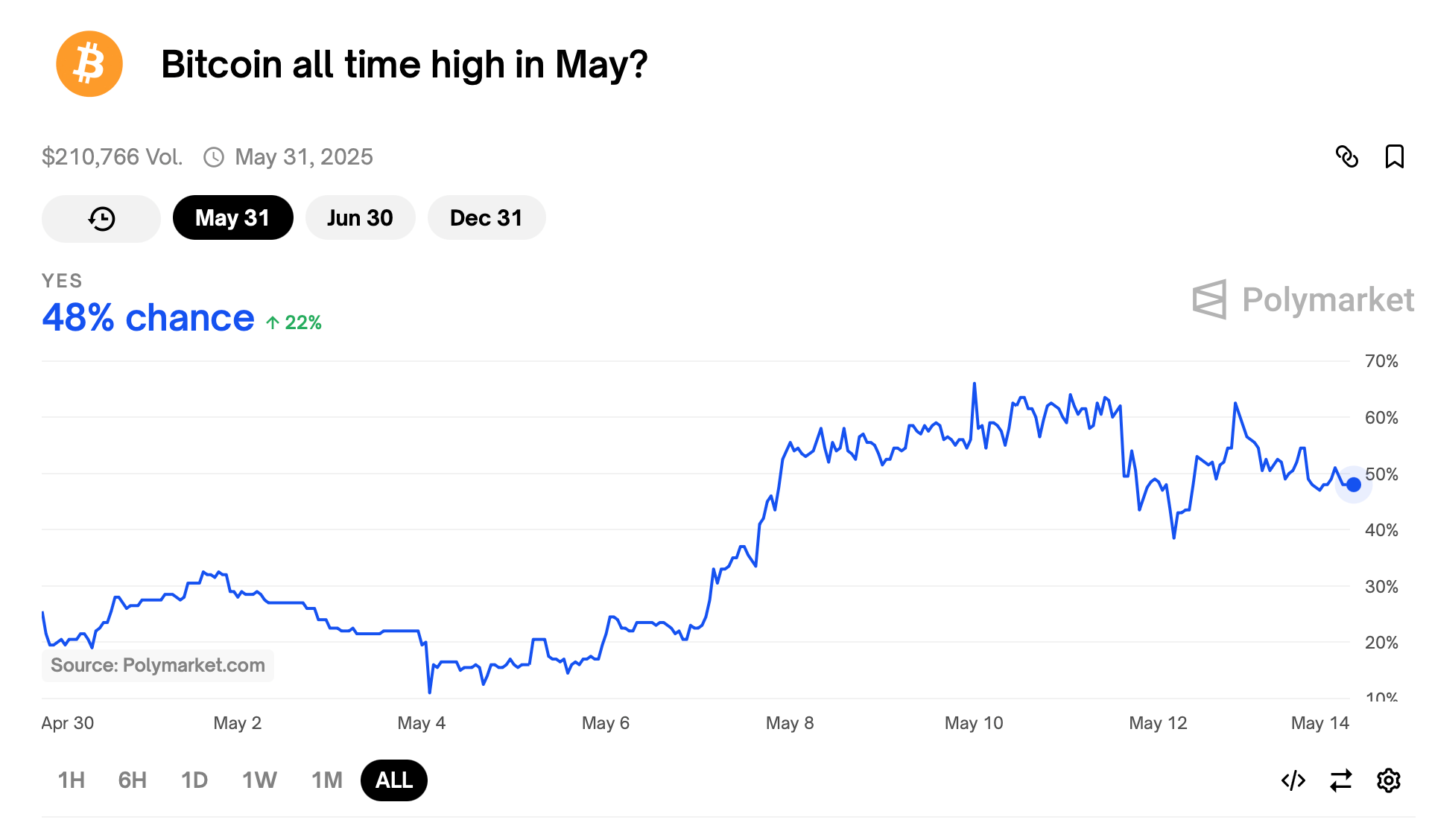

Kalshi Bettors will assign an 18% chance of reaching $150,000 by October and a 6% chance of reaching July. With two weeks remaining in May, another polymate bet ($210,766 volume) gives you a 48% chance of BTC reaching a new all-time high by the end of the month.

These predictions reveal a compelling combination of attention and optimism among betting participants, suggesting that price fluctuations could withstand even if fresh records fell. The sentiment supported by both historical precedents and positive bets draws a picture of a market where expectations are shaking between euphoria and prudence that is as unstable as the assets themselves.