October was a month of ups and downs. Bitcoin Despite seasonal promises of “uptober” profits, traders and investors did not.

Historically October has been a good time. Bitcoin Holders have recorded green months in 10 of the past 12 years, averaging returns of more than 20%. According to data from Coinglass, Bitcoin is currently trading at a relatively modest value of +1.14% for the month.

Bitcoin soared above $123,000 in early October, but plummeted to $107,000 by mid-month, a 13% correction that erased weeks of gains in a matter of days. Since then, the bull market has slowly returned to its current level of around $115,000.

Currently trading at $115,542, Bitcoin has managed to remain above this important threshold despite volatile price movements throughout October. The question now facing traders is whether Uptober will live up to its name and finish with Bitcoin in the green.

Traditional markets are firing on all cylinders, with the S&P 500 hitting a new all-time high of over 6,900 points on Tuesday. Investors are pricing in a possible quarter-point rate cut when the Federal Reserve announces its decision on Wednesday, which would bring interest rates down to a range of 3.75% to 4.00%, typically bullish territory for risk assets like cryptocurrencies.

The rally was also fueled by Treasury Secretary Scott Bessent’s hint at a framework for resolving the U.S.-China trade dispute ahead of next week’s meeting between President Donald Trump and President Xi Jinping. This combination of dovish monetary policy and geopolitical risk mitigation has driven the risk-on sentiment that crypto markets typically track.

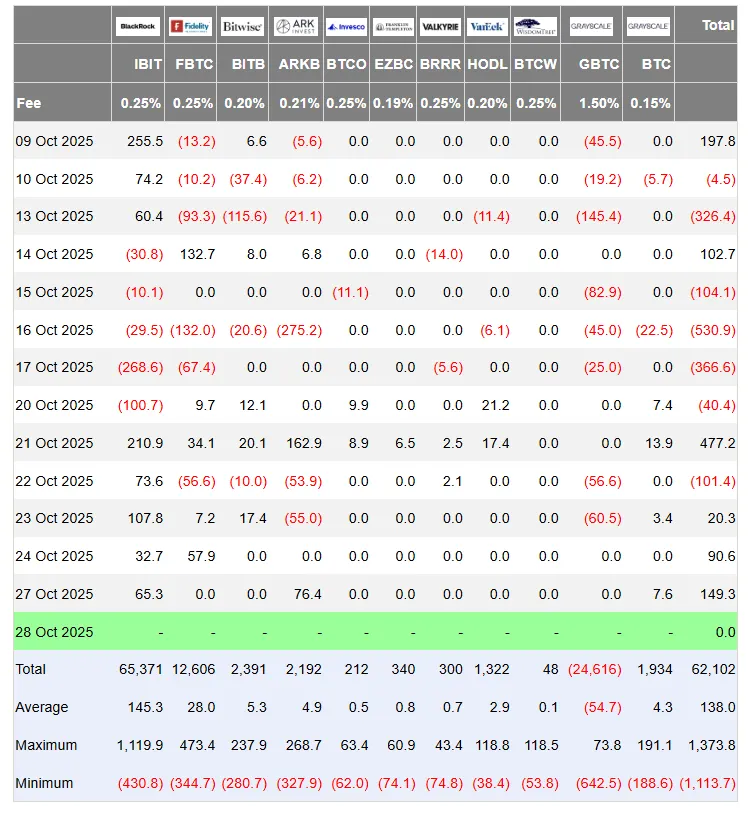

Perhaps most telling about Bitcoin’s near-term outlook, the Spot Bitcoin ETF recorded its third consecutive day of inflows, raising $149 million as of yesterday.

Bitcoin ETFs are experiencing inflows. Image: Far Side Investor

When institutional money flows into Bitcoin through regulated products, it usually signals confidence from larger players, the kind of demand that supports price stability.

Bitcoin technical breakdown: Bulls build strength

So, will Bitcoin end the month in green or red?

Due to the short time frame of the forecast, we used a 4-hour candlestick setup for our analysis.

The short-term chart shows a bullish structure, suggesting that Bitcoin is more likely to sustain and extend its rally above $114,200 than below. At least for the time being, price appears to have broken through the resistance line that signaled a correction (dotted red line on the chart below) and rebounded in the ascending channel (dotted green line on the chart).

Bitcoin price data. Image: Tradingview

The average directional index (ADX) is 32.14 and is marked as “Strong” on the chart. This indicator measures the strength of a trend on a scale of 0 to 100, regardless of direction. A reading above 25 confirms an established trend, while a reading above 30 suggests strong momentum. When ADX continues to rise above 25, it usually indicates that the trend has legs and is likely to persist rather than reverse soon.

The Relative Strength Index (RSI) of 69.05 tells an interesting story. The RSI measures momentum by comparing the magnitude of recent gains to recent losses, and readings above 70 indicate overbought conditions where profit taking is frequent. Bitcoin is approaching that zone at 69, but not quite there. Therefore, there is room to run for the next three days before Bitcoin next hits overbought territory and triggers an adjustment in algorithmic trading settings.

Exponential moving averages (EMAs) tell traders where price support and resistance are by taking the average price of an asset over the short, medium, and long term. In the case of Bitcoin, the 50-period EMA (average price of the past 50 4-hour trading sessions) is below the 200-period EMA, generating a “short” signal on the 4-hour time frame.

This configuration, sometimes referred to as a “death cross” when it occurs, usually indicates a bearish market structure because it means short-term prices are on average lower than long-term prices. However, the current price action is trading well above both moving averages, with the EMA 50 indicating an upward move indicating a possible golden cross (above the EMA 200 would be a bullish setup).

The squeeze momentum indicator flashes on a “bullish impulse” with a “long” signal. Developed by trader John Carter, this indicator identifies when volatility is compressed (like a spring being squeezed) before an explosive move. When the squeeze “fires” with bullish momentum, it signals the end of the compression phase and the beginning of a directional move. A “bullish impulse” status means that not only has the squeeze been triggered, but momentum is accelerating upward. Traders typically interpret this as a likely setup for continued profits, especially when combined with other confirmatory indicators such as rising ADX.

Finally, Ichimoku cloud analysis shows that Bitcoin is trading above the cloud (price is stronger than the previous trading session) and future clouds are predicted to be bullish. For traders new to this Japanese charting technique, think of the cloud as a dynamic support/resistance zone. When prices are trading above a bullish cloud with expanding momentum, it usually indicates a continuation of the trend rather than a reversal.

Finally, if Bitcoin respects the current price support, even the lowest price would be $622 above the opening price registered on October 1st. That’s only 0.5% above the target, but still above 0.

likely to be green

Can Bitcoin end October above $114,200? Technical evidence suggests that it is possible. If this trend continues, this Uptober could become a short-body Doge. Prices fluctuate wildly in the middle, but more or less start where it started. In other words, it may end up being a small profit, but still a positive one.

With BTC currently trading 1.2% above that level and showing strong trend confirmation across multiple indicators, the path of least resistance appears to be towards a sideways-to-highs rather than a breakdown below the monthly open.

The immediate support zone is approximately $114,000 to $114,500, consistent with the monthly open and recent consolidation area. For Bitcoin to end October in the red, it would need to break through this support zone and remain below it for the remaining days of the month, but this scenario is unlikely given the current ADX numbers, bullish momentum indicators, and supportive macro backdrop.

Sentiment remains broadly bullish at the moment, with Myriad tradersA prediction market developed by Dastan, Decrypt’s parent company, prices Bitcoin as having a 70% chance of continuing its rise towards $120,000 and then dropping to $100,000. These odds now look quite different from six days ago, when traders were predicting a 56% chance of Bitcoin falling to $100,000.

However, traders should always be aware that Wednesday’s Fed policy announcement represents a binary risk event. Markets are pricing in a 25 basis point (bp) rate cut, but hawkish comments on the future path of interest rates could cause short-term volatility. The key question will be whether Bitcoin can sustain support above $114,000 in the event of a Fed-related disruption.

Main levels to note:

- Instant support from $114,000 to $114,500 (monthly open zone);

- Strong support at $112,000 (recent solid lows),

- Immediate resistance at $116,000 (recent rejection point),

- Strong resistance between $118,000 and $120,000 (psychological barrier and volume gap)

Disclaimer

The views and opinions expressed by the authors are for informational purposes only and do not constitute financial, investment, or other advice.

mark