Ethereum (ETH) traders are watching carefully as large holders began their major on-chain move this week.

Cryptocurrency surpassed key resistance at $1,620, hitting a high of nearly $1,705, pushing it to nearly $1,800.

Market participants are questioning whether this momentum can boost Ethereum to $1,850.

However, recent whale trading and chain activity can affect price direction in the short term.

With the price targeting $1,850, Ethereum will skyrocket past key resistance

Ethereum launched a strong bullish movement as it closed its trading range from $1,555 to $1,620.

Prices exceeded resistance levels and reached $1,705 to the new best points over this short period.

The upward movement has developed support for Ethereum to occur after several days of traded sideways and thereby increasing.

After reaching $1,705, Ethereum prices brought resistance closer to $1,720 and began consolidation at over $1,693.

A shared chart of market analysts showing that bullish continuity is possible if Ethereum had more than $1,693 support.

The breakdown below this point could open the door to retesting the support zone for $1,660 and $1,620.

Market participants continuously observed volume levels and validated permanent buyer participation.

Professional analysts predict that if prices exceed $1,720, they will increase the chances of price rising to $1,850.

Source: x

Analyzing ETH/BTC price pairs added complexity to the study. The relative value of Ethereum compared to Bitcoin experienced a decline of more than 79% from its highest point in 2021.

The trading pair maintained a position close to 0.01835, one of the lowest points in its multi-year history.

The changing market emotions towards the Ethereum ecosystem and positive feelings towards its network will lead to potential ETH/BTC relationships.

Whale trade raises concerns about short-term sales

Large holders have made several notable deals following a surge in Ethereum prices. The wallet linked to the Ethereum Foundation has moved 1,000 ETH, worth around $1.58 million, to Exchange Kraken.

Blockchain records show that the wallet received 84,513 ETH, a decade ago with the asset priced around $1.20.

Another large deal came from a whale that borrowed 15,000 ETH from Aave and sold for 24.9 million USDT.

The average selling price was around $1,660. The move came shortly after the recent price rally, leading to concerns that other large holders could follow similar behavior.

After the price of $eth rose, the whales borrowed $15,000 eth from #aave and dumped it at an average price of 1,660.https://t.co/9x1zeatzze pic.twitter.com/vimz9waurc for 24.9m$USDT.

– lookonchain (@lookonchain) April 22, 2025

According to blockchain analysts, the transaction occurred within 15 minutes. The rapid trading and its large volume made investors worried about the intense impact of market sellers.

On-chain metrics show potential for accumulation zones

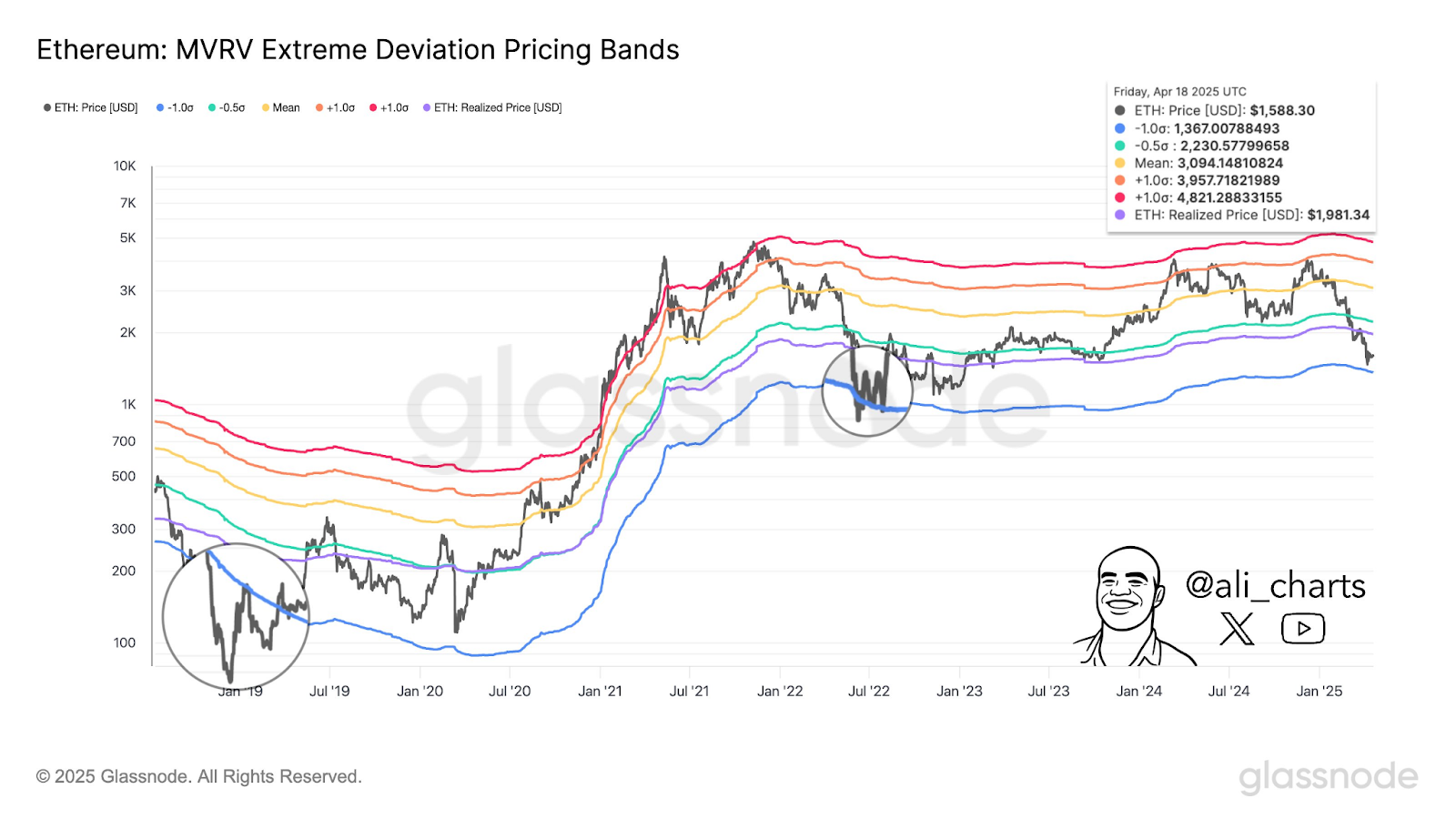

Ethereum’s MVRV price range presented a different perspective on the asset market standing in April 2025.

The market valued Ethereum at $1,588.30, but it was actually worth $1,981.34.

The Ethereum is located at the bottom of the MVRV deviation band, with historical data indicating that purchasing activity steers towards accumulation.

GlassNode data showed that it falls into the previous band, among the established bottom points of the market in 2018 and 2022.

Analysts followed this data point as they revealed the sentiment of long-term holders and market players in the Bitcoin market.

Price ranges indicate ongoing sales or weak demand if they remain stable over the long term.

Source: x

Current prices received positive and negative ratings from traders due to whale trading and wider market conditions.

The Ethereum market showed signs of recovery to reach the previous MVRV band, including the $3,094 mark.