The market capitalization of tokenized gold exceeds $1.2 billion, leading to rising gold prices and a growing appetite for blockchain-based assets.

The growing interest in tokenized gold is part of a broader movement to modernize storage, trading and utilization in financial markets.

Gold satisfies blockchain in the tokenization revolution

Gold prices have reached historic highs of over $3,000 per ounce. This surge will attract investors’ interest in digital representations of precious metals such as Tether Gold (Xaut) and Paxos Gold (Paxg).

Gold price performance. Source: TradingView

Don Tapscott, co-founder of the Blockchain Research Institute, argues that tokenized gold can transform the $13 trillion gold market by bringing transparency, liquidity and a new financial model.

Based on this assumption, he questioned why gold was still stored in safes in the 1800s. Meanwhile, assets such as Bitcoin (BTC) and Stablecoins have now become digital. He believes that blockchain technology can revolutionize the role of gold in finance.

“The US government has been able to tokenize gold reserves, track them improperly and even use them in innovative ways,” explained Tapscott.

He said such results allow for small ownership, validation of chains and increased accessibility to investors around the world.

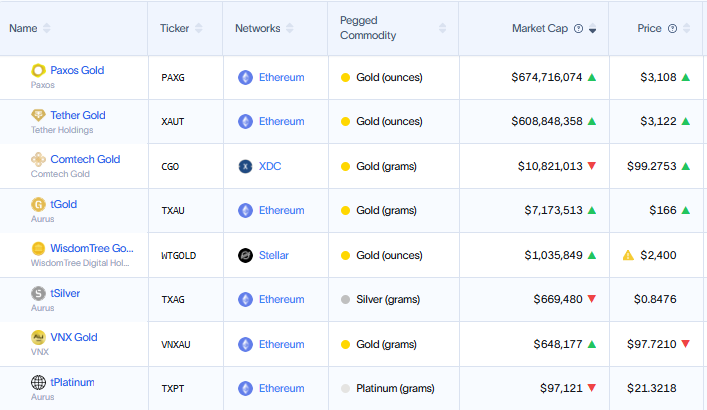

Meanwhile, companies like Paxos and Tether lead the fees in offering tokenized gold. Paxos holds a market share of 51.74%, while Tether’s holdings are closely behind at 46.69%.

Holdings of tokenized gold. Source: rwa.xyz

Publicly available Matador Technology takes a unique approach by symbolizing gold in the Bitcoin blockchain. This will provide investors with digital claims about both physical gold and limited edition digital art.

“We believe that the next generation of financial powers are likely to emerge from the tokenization revolution. It’s still too early and the arenas are open to the public.

Gold tokenization in the US: Bold policy changes?

The momentum behind tokenized gold has also reached the US government. Following the March 5 executive order to establish a Strategic Bitcoin Reserve (SBR), policymakers are looking for ways to modernize gold holdings.

Treasury Secretary Scott Bessent has shown that the US will move to “more assets,” with some speculating that Fort Knox Gold could be tokenized.

“US Treasury Secretary Scott Bescent says that there are no plans to visit Fort Knox or reassess the gold reserves in the Sovereign Wealth Fund. He talks about “Bloomberg Surveillance.”

Senator Cynthia Ramis has also proposed to exchange some of the US government’s gold reserves in Bitcoin. US gold reserves have a book value of $42 per ounce (used since 1973) of over $3,000 per ounce.

The US is exploring tokenization, but geopolitical rivals may take even more bold steps for China and Russia – a gold-backed stubcoin. Bitcoin Maxkiser recently highlighted BRICS’s plan to introduce gold-backed stubcoins.

“Mostly Russia, China and India will fight against the US’s hegemonic and USD-supported stablecoin – a gold-backed stubcoin. Determine gold over USD-ribacoin.

Additionally, Keizer suggested that gold-backed Stablecoin would beat USD-backed stubcoin in the global market. He argues that gold is more trusted than the US dollar, effectively tracks inflation and remains minimally volatile compared to Bitcoin’s price movements.

Bitcoin’s recent rejection of the national assets fund that Russia supports gold and China’s yuan adds weight to this theory.

An estimated 50,000 tonnes of gold reserves allowed China and Russia to leverage blockchain technology to introduce new gold-supported digital assets. Such actions will challenge the US dollar’s domination in global trade.

Gold vs Bitcoin: The debate on safe shelters intensifies

Gold’s record-breaking rally rekindled debates over its role as a safe inventory asset compared to Bitcoin. Some analysts speculate that Bitcoin can quickly trace the gold trajectory and set a new all-time high.

But in economic uncertainty and President Trump’s 2025 tariff policy, gold remains a priority safe haven asset. Historically, gold has become a value-leading factor during trade wars and inflation. Meanwhile, Bitcoin volatility raises concern for risk averse investors.

Despite these differences, the rise of tokenized gold highlights the convergence of traditional finance and digital finance. As financial markets advance and investors rebalance their portfolios, gold and Bitcoin could coexist in the modern currency system.

Financial stadiums are changing through tokenization, gold-backed stubcoins or government-led blockchain initiatives.

As traditional institutions increasingly adopt blockchain, this stage is set to change the way gold is recognized, traded and stored compared to Bitcoin.