Volt (XVM), a token linked to actual asset (RWA) tokenization. It increased sharply in early September 2025. Prices rose more than 120% within 24 hours. This makes it one of the fastest movers on the market. Coingecko’s data showed token peaking at $0.02171 before pulling back slightly. Even after the retracement, XVM remained up nearly 90% that day. This reflects intense trading activity.

The surge was also coincided with an increase in the number of holders. The XVM token surpassed 8,700 unique wallets. This indicates an increase in retail participation. Traders pointed out the wider excitement around the RWA story. As the main factor behind the rapid climbing of tokens. Momentum highlighted how new themes in crypto could drive a sudden surge in market interest.

Price action and trading volume

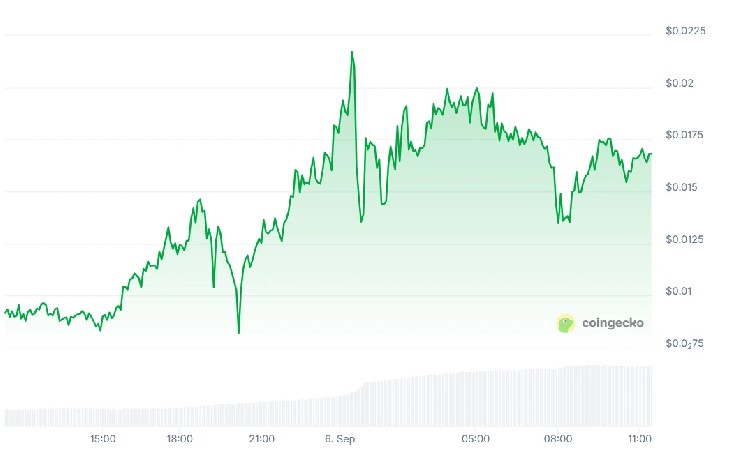

Yesterday brought exceptional volatility to the XVM token. The token bottomed at $0.0067 before moving to a new all-time high. At the time of writing, it was trading about $0.01618. That’s still well above the 24-hour low. The trading volume was equally impressive, exceeding $7 million within the period. Analysts said such high sales confirmed strong market involvement.

Chart: XVM/USD 24-hour chart by Coingecko, September 6, 2025

The large green candles on the trading chart reflect the buyer’s control during the rally. But dips from the highs of the day also suggest that they make a profit. This is typical after a steep increase in steep slopes. Marketwatchers said the move carried a speculative undertone. Because bolts are still in conceptual stages. Price action seemed more dependent on emotions than the foundation of the project. Still, the rally placed the XVM token among the top-performing digital assets of the day.

RWA’s story wins the ground

Real-world asset tokenization has become one of the most influential crypto themes of 2025. This idea focuses on traditional assets conversion. It has been converted into blockchain-based tokens, such as real estate and government bonds. Tokenization provides partial ownership. Increased fluidity and transparency. These features make RWA attractive to retail investors and institutions. Interest in this sector has increased as higher fees in traditional finance have increased investors towards alternatives.

For example, the tokenized US Treasury bill offers competitive on-chain yields. This brings a fresh capital into the space. Larger financial companies like BlackRock and Franklin Templeton are also investigating tokenization, adding weight to the story. Market analysts currently place RWAs along with themes like AI-driven agents. Bitcoin Staking is an important driver for the next cycle. This sector is considered a bridge between traditional finance and debt. It unlocks trillions of potential value. For projects like Volt, this wave of attention brings momentum. Even if their ecosystem has not yet been fully developed.

Bolt and its impact on investors

In the case of XVM, this gathering may have been driven by speculation linked to broader RWA trends. The bolt platform remains in the planning stage. There is no finished product. This will reduce recent prices that concern immediate utility and more about future expectations. This dynamic also identifies risks associated with such assets. Volatility is common in cryptography. However, tokens without established platforms face even more sharp swings. Investors are advised to approach with vigilance. While the theme of RWA is compelling, projects like Volt convey uncertainty until the ecosystem proves functional. The increase in ownership shows that retailers are willing to support early stage narratives.

Future outlook

XVM Token’s Rapid Clive highlights how quickly emotions change in the digital asset market. The token’s powerful performance really caught the attention. Even if it was driven primarily by speculation. For many investors, this surge reflected optimism about the long-term role of RWA in reshaping finance. Bolt’s challenge is to translate this early attention into sustained growth. It is important to provide planning within the Solana and XRP Ledger ecosystems. Until then, XVM prices may continue to reflect investors’ expectations and broader RWA market trends.