According to a detailed Coingecko report, Ethereum sales by the Ethereum Foundation (EF) do not significantly affect token prices as commonly believed.

“Does the sale of Ethereum Foundation (EF) cause significant market movements?” Coingecko asked in a tweet. There, we uncovered the latest research that proves that the sale of Ethereum Foundation of ETH below 9k is not significantly positively correlated with price changes.

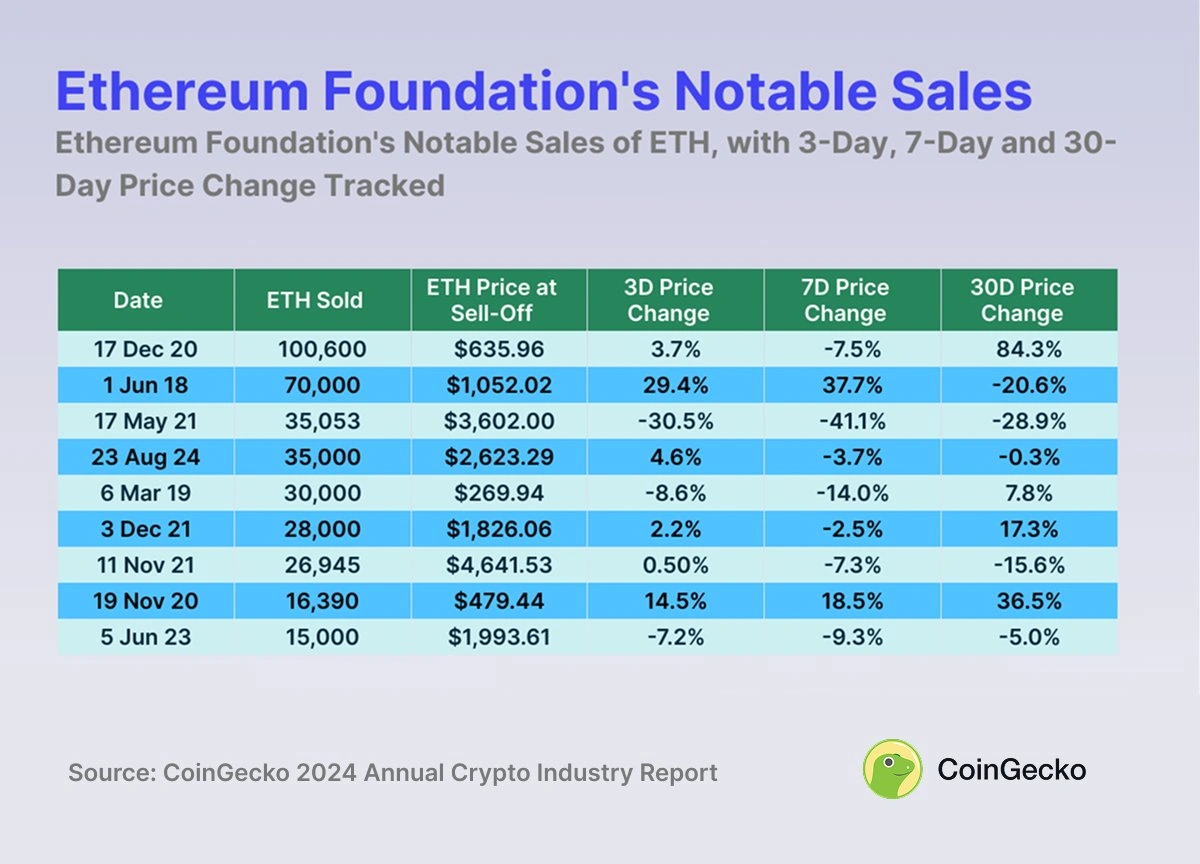

The same cannot be said for sales exceeding 15K ETH. For example, one example of the basic selling 70K ETH was 20.6% DIP, with 16.3K ETH sales followed a 36.5% rise.

For the purposes of the investigation, Coingecko analyzed the sale of EFs from October 16, 2017 to January 15, 2025 using public on-chain data from Dune, Etherscan and Coingecko. Note that only ETH transactions above 100 ETH are considered, and the analysis does not take into account market trends or macroeconomic events.

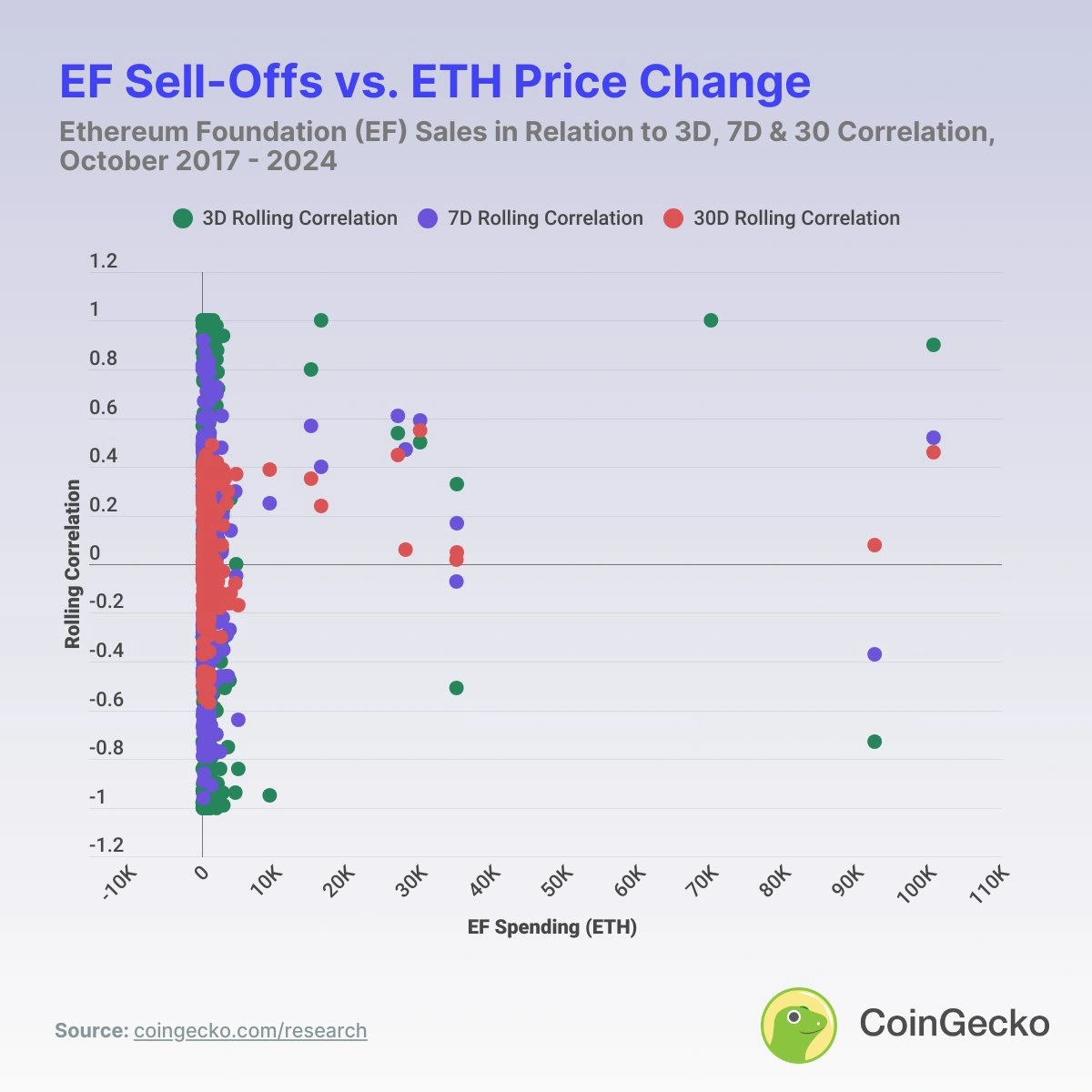

Ethereum Foundation ETH sales have had different impacts on prices over the 3, 7 and 30-day time frames. Source: Coingecko

Coingecko’s findings confirm the relationship between EF sales and ETH price action

According to the report, the average price change for ETH over the seven days after the sale of EF is +1.3%. The report does not disprove the claim that a massive sale of the Ethereum Foundation (EF) will trigger an immediate market response. However, they argue that these movements are not uniformly negative.

The percentage of cases where ETH prices have fallen within seven days of the sale of EF is -47.6%, suggesting that less than half of EF sales will result in immediate price drops. In fact, Coingecko argued that in most cases EF sales activities do not cause deep diving in Ethereum prices.

Since the sale was made, the largest weekly decline on record after EF sales was -41.1%.

Some sales lead to prominent short-term responses. For example, a sale that occurred on May 17, 2021 caused prices to plummet within a week at -41.1%.

Coingecko argues that such levels of decline are not universal as other large transactions can instead coincide with price increases. Also, despite the huge sale, ETH prices saw pumps in 164 cases, but fell to 149 cases.

The mixed results are evidence that EF spending is not a reliable ticket to a bloody ETH chart.

Over the 30-day range, the foundation’s sale after an average ETH price change is +8.9%.

Ethereum Foundation spending varies with ETH prices across different time frames

To further explore the relationship between EF expenditures and ETH price action, Coingecko analyzed the rolling correlation over three time frames: 3 days, 7 days, and 30 days.

Sales from the famous Ethereum Foundation. Source: Coingecko

Data revealed that the rolling correlation over the 3-day ranged from -0.999 to +0.999. This indicates extreme volatility, suggesting that short-term price movements could be strongly influenced by broader market conditions rather than EF expenditures.

One case confirming this happened was on November 19, 2020, when the rolling correlation reached 0.9998 after EF sold 16,390 ETH and the price of the ETH rose from $479 to $560 over four days.

Of course, EF was sold and ETH could suffer a price drop over the next three days.

However, in both cases, the short-term correlation proves that it is highly sensitive to market sentiment and fluidity, rather than what the Ethereum Foundation does with ETH reserves.

Unlike the 3-day correlation, the 7-day rolling correlation has less volatility and generally varies between -0.7 and +0.7. This shows a more stable but inconsistent relationship between EF expenditures and ETH prices over the weekly time frame.

The 30-day rolling correlation provides insight into broader market trends. For example, between 2018 and 2020, the correlations are primarily positive, often above 0.3.

This means that EF funding activities may be related to market trust and growth, particularly during the early stages of ecosystem expansion, in the bare market.

However, since 2021, the correlation has gradually flowed to neutral or negative values, a change that reflects the impact of Ethereum’s market maturity and greater macroeconomic power.

As far as sales distribution is concerned, there is no significant positive correlation between changes in ETH prices and sales of ETH below 9K. However, it is reported that when more ETHs are sold, stronger positive correlations will appear in most cases.

Coingecko analysis revealed that the 30-day rolling correlation between EF expenditure and ETH prices was concentrated primarily between -0.3 and 0.5, indicating a weak to moderate relationship.

The 7-day rolling correlation follows a similar distribution, but shows more variation, while the 3-day rolling correlation is more extreme, with high concentrations, highlighting a sharp but inconsistent short-term response to EF sales.

All of these findings confirm that long-term correlations are weak and inconsistent when Ethereum Foundation sales often affect price movements in the short-term time frame.