Ethereum prices rose above the $3,000 threshold after a critical breakout past multiple resistance zones. As of July 14th, today’s Ethereum Price holds nearly $3,046, a 2.5% increase in the last 24 hours. The rally is supported by both a structural bullish shift and an accelerated demand in the derivatives market.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

Daily charts show that Ethereum prices from a multi-month accumulation range of $2,400 to $2,800 collapse, causing a clean bullish structural shift. ETH Price has now regained its $2,970-$3,000 supply block, which thwarted progress between June and early July. The current structure shows that ETH forms a higher and higher low, and is currently trading beyond May.

Ethereum prices also cleared the major descending trend line, which was extended from November 2024, showing a reversal in a broader trend direction. Breakouts are supported by visible volume strength and a strong base formed near the demand block between $2,680 and $2,700.

The 4-hour Bollinger Band checks for updated volatility cycles. Price is pushed up above the upper band, keeping support from the 20/50 EMA cluster between $2,945 and $2,814. As long as ETH remains above the midband ($2,972), this trend remains bullish.

Why are Ethereum prices rising today?

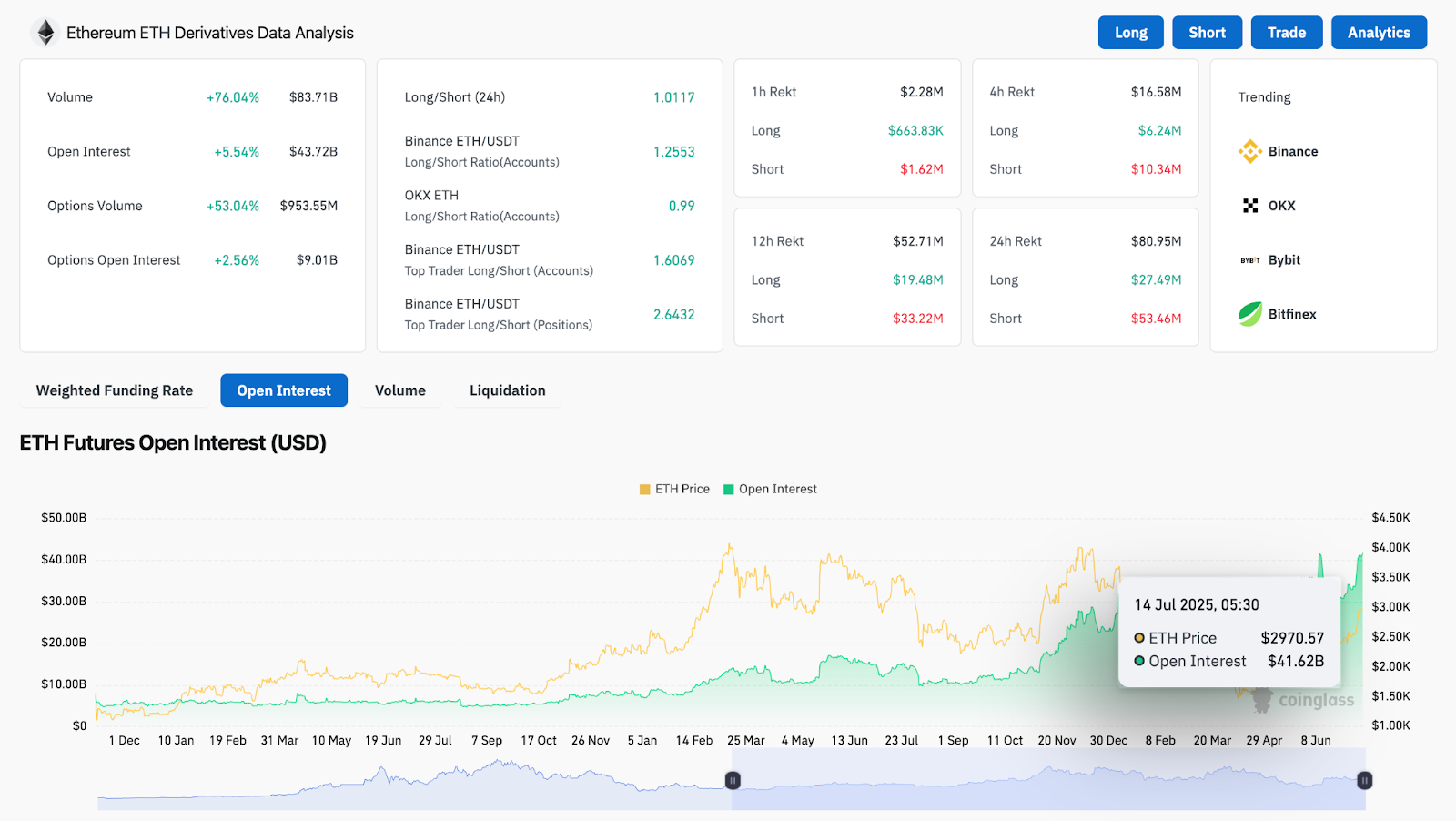

ETH derivative analysis (source: Coinglass)

Recent rise in Ethereum prices has been driven by strong derivatives activities and technical breakout signals. Open interest in ETH futures has increased by 5.54% in the past 24 hours to $43.72 billion, according to Coinglass data. Total volume increased by 76%, and the amount of options exceeded 53%. Binance’s long ratio is 1.61 among top traders, with the top position ratio rising to 2.64, reflecting a wide long bias.

ETH Price Dynamics (Source: TradingView)

From a price action perspective, the 30-minute chart shows a bullish continuation after a shallow pullback to $3,030. The RSI bounces back to 65.1, leaving the neutral region. MACD also prints a positive crossover when magnifying the histogram bar, indicating fresh purchase momentum.

ETH Price Dynamics (Source: TradingView)

On the Smart Money Concepts (SMC) chart, ETH broke keychock levels and played Bos zones above $2,900. The current $3,000 push is in the low-liquid zone up to $3,260. This could support rapid price acceleration.

Price indicator signals acceleration towards 0.618 FIB level

ETH Price Dynamics (Source: TradingView)

The weekly Fibonacci retrace from the top of $4,106 to a low price of $1,385 shows that Ethereum prices are currently testing a significant 0.618 retracement level at $3,061. Being close to the week above this mark indicates a wider trend reversal, targeting the next upside zone of $3,524 (FIB 0.786).

ETH Price Dynamics (Source: TradingView)

Daily RSI remains in bullish territory without showing extreme over-acquisition conditions, and BBP (Blue Bear Power) on the weekly chart continues to rise, indicating the strength of healthy underlying trends.

This structure is also consistent with the long-term upward trend line, extending from the 2022 cycle low. ETH Prices have recouped this trendline and reversed it into dynamic support, further acknowledging the current upside breakout as a potential trend reopening.

ETH Price Forecast: Short-term Outlook (24 hours)

Ethereum prices may test $3,061 resistance (FIB 0.618) over the next 24 hours. Clean closures above this level could ignite a run heading towards $3,260 and $3,524, especially if volumes remained rising and funding rates are neutrally positive.

ETH Price Dynamics (Source: TradingView)

In the short term, if prices fall below $3,000 again, initial support will follow $2,972 (Bollinger Midband), followed by $2,945 (EMA20 4H) and $2,814 (EMA50 4H). A breakdown below $2,814 risks negating bullish bias, leading to a pullback to $2,700.

However, given the current RSI-MACD alignment, increased open interest and bull market structure, Ethereum is poised to continue to continue above $3,061, with short-term volatility likely to continue rising.

Ethereum price forecast table: July 15, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.