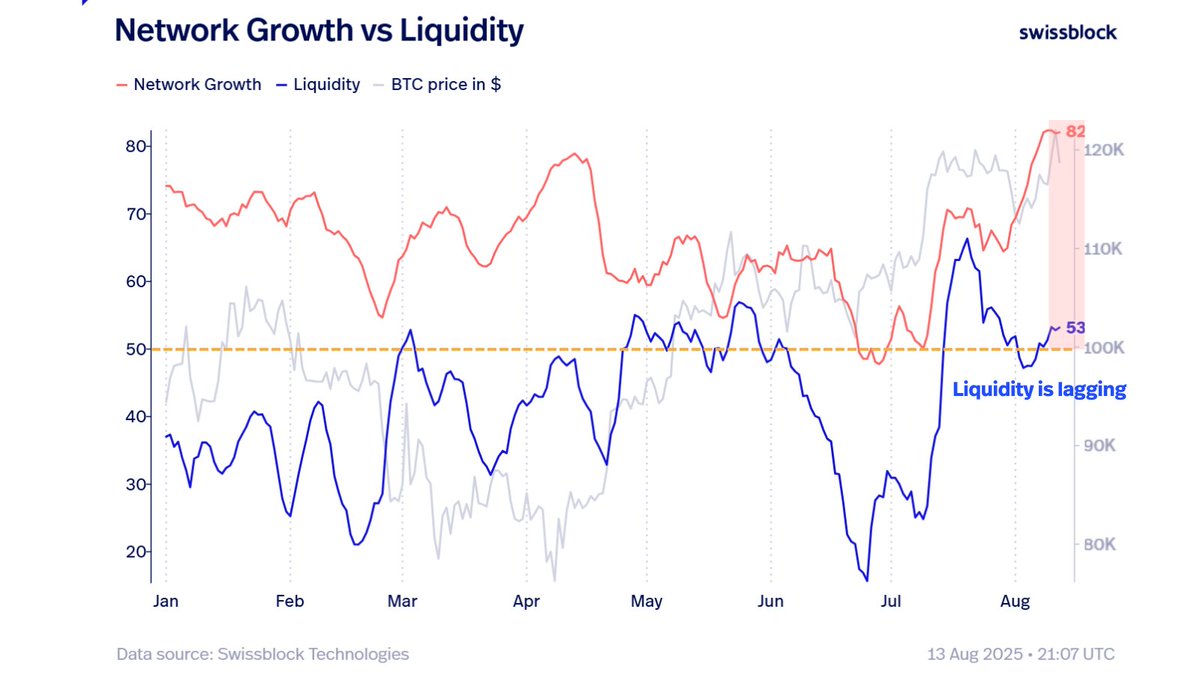

According to the Crypto Analytics Platform SwissBlock, one key ingredient is missing as Bitcoin (BTC) is well past its all-time high.

According to the Analytics platform, on-chain liquidity metrics need to be increased to trigger a compelling Bitcoin breakout.

On-chain liquidity refers to how easy and efficient you can buy and sell Bitcoin without significantly affecting the price of BTC. The low liquidity environment suggests that there are not enough buyers to absorb sell orders, causing prices to drop.

“The structure of BTC is strong, but liquidity is a catalyst for breakouts beyond the convicted ATH (highest ever), while the capital rotation to ETH and ALT is completely moving. It sets the out-performance stages of slow cycle Altcoin.

Source: SwissBlock/X

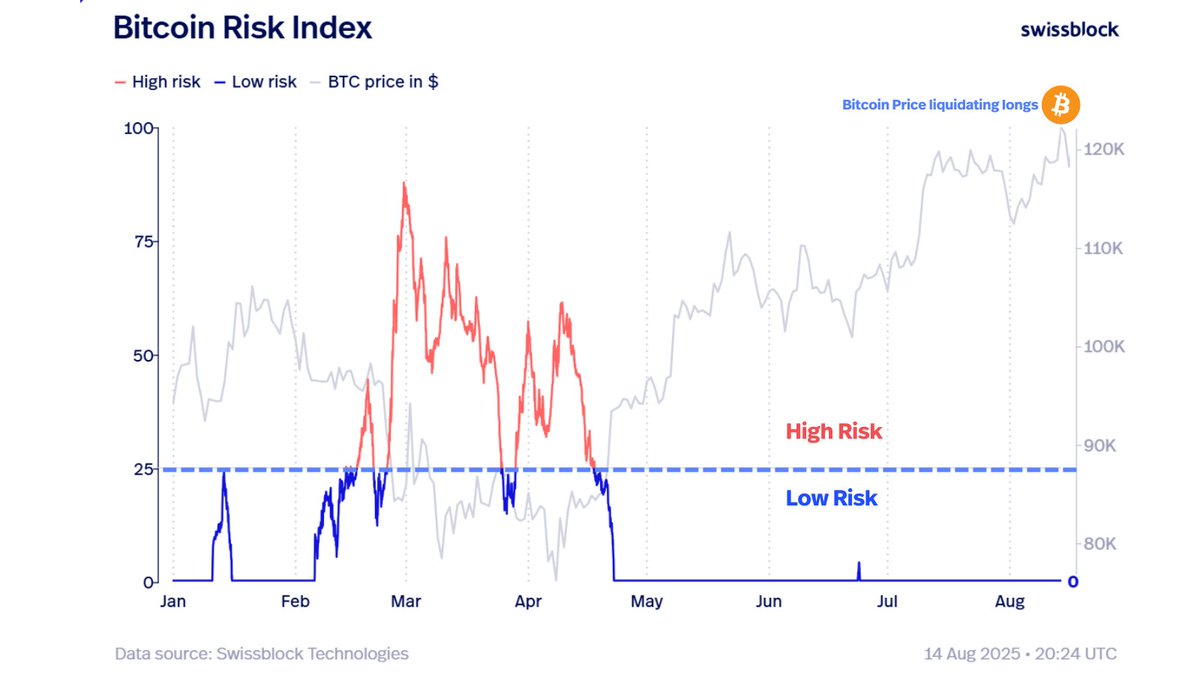

SwissBlock also states that flagship crypto assets remain in the bull market based on Bitcoin’s risk index, and short-term revisions are a great opportunity for investors.

Metrics aim to assess the current risk environment for Bitcoin by aggregating a variety of data points, including on-chain valuations and cost-based metrics.

“As long as the risk remains low, this is a buy-the-dip environment. Bitcoin punishes things that are stacked in the short term, and negative volatility is rising, but structural risks are curtailed. Low-risk regime: dip is an opportunity.”

Source: SwissBlock/X

Bitcoin was trading at $117,422 at the time of writing, a slight decline for the day.

Generated Image: Midjourney