As of 8:50 a.m. ET on Tuesday, Bitcoin was trading at $93,788 with a market valuation of about $1.87 trillion, making its presence loud and clear even on a quiet trading day. Trading volume in the past 24 hours reached $50.09 billion, with prices hovering between $92,474 and $94,792, a tight, tense, textbook consolidation. Whether it’s reeling toward a breakout or preparing for a breakout, the chart is holding its breath and the next move could be explosive.

Bitcoin chart outlook

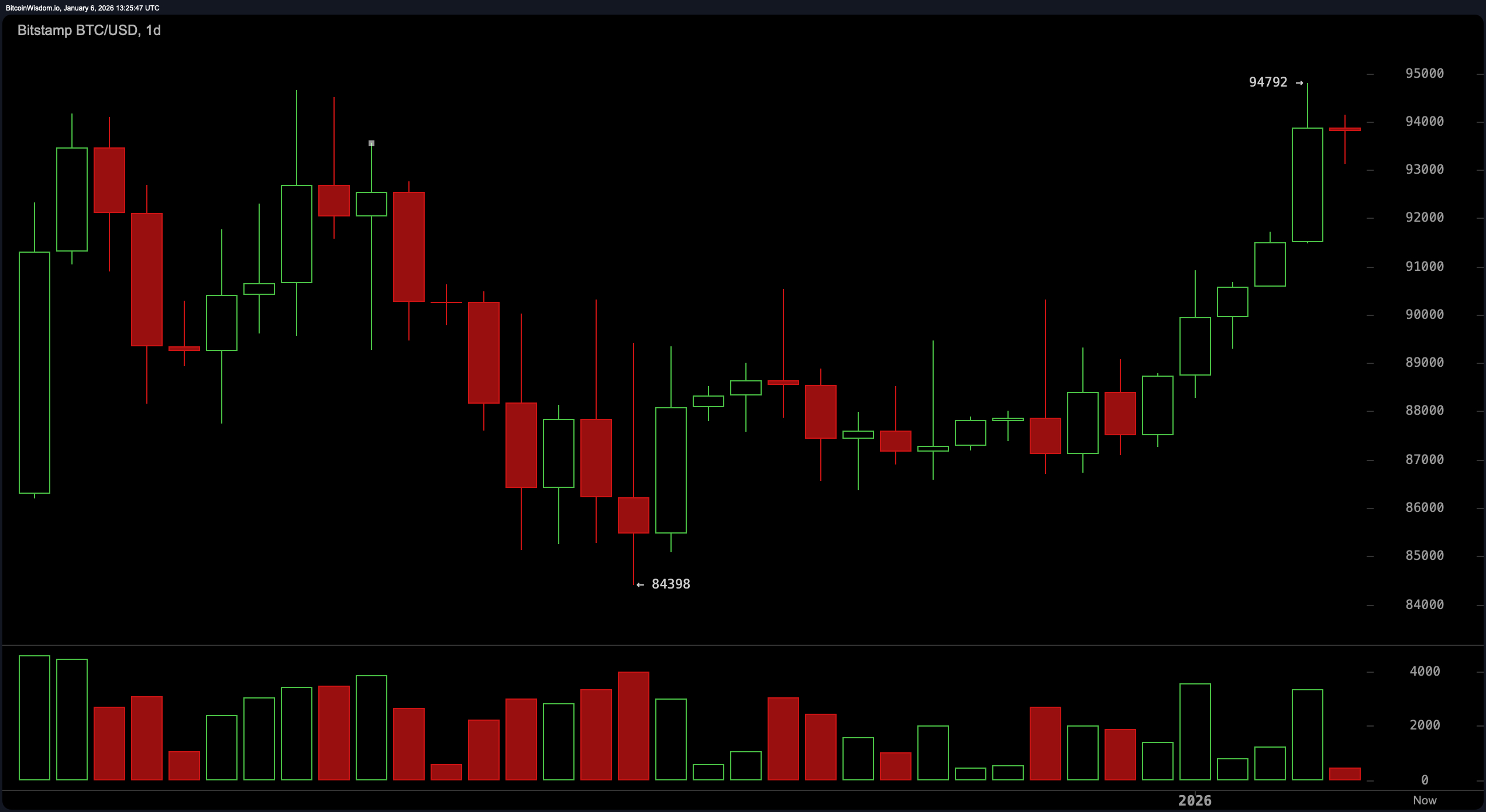

From a daily chart perspective, Bitcoin is strutting confidently after holding the $84,400 level, marking a textbook low. Its high-low structure remains unchanged, suggesting that the market is still under buyer influence, even if it is currently taking a breather below the $94,800 resistance zone.

This volume tells the story of two moods. Enthusiasm on the way up and hesitation at the height. Unless Bitcoin falls below the $90,000-$91,000 zone on daily closes, the upward march remains likely. Think of this as a dramatic consolidation phase rather than a fake collapse.

BTC/USD 1-day chart via Bitstamp for January 6, 2026.

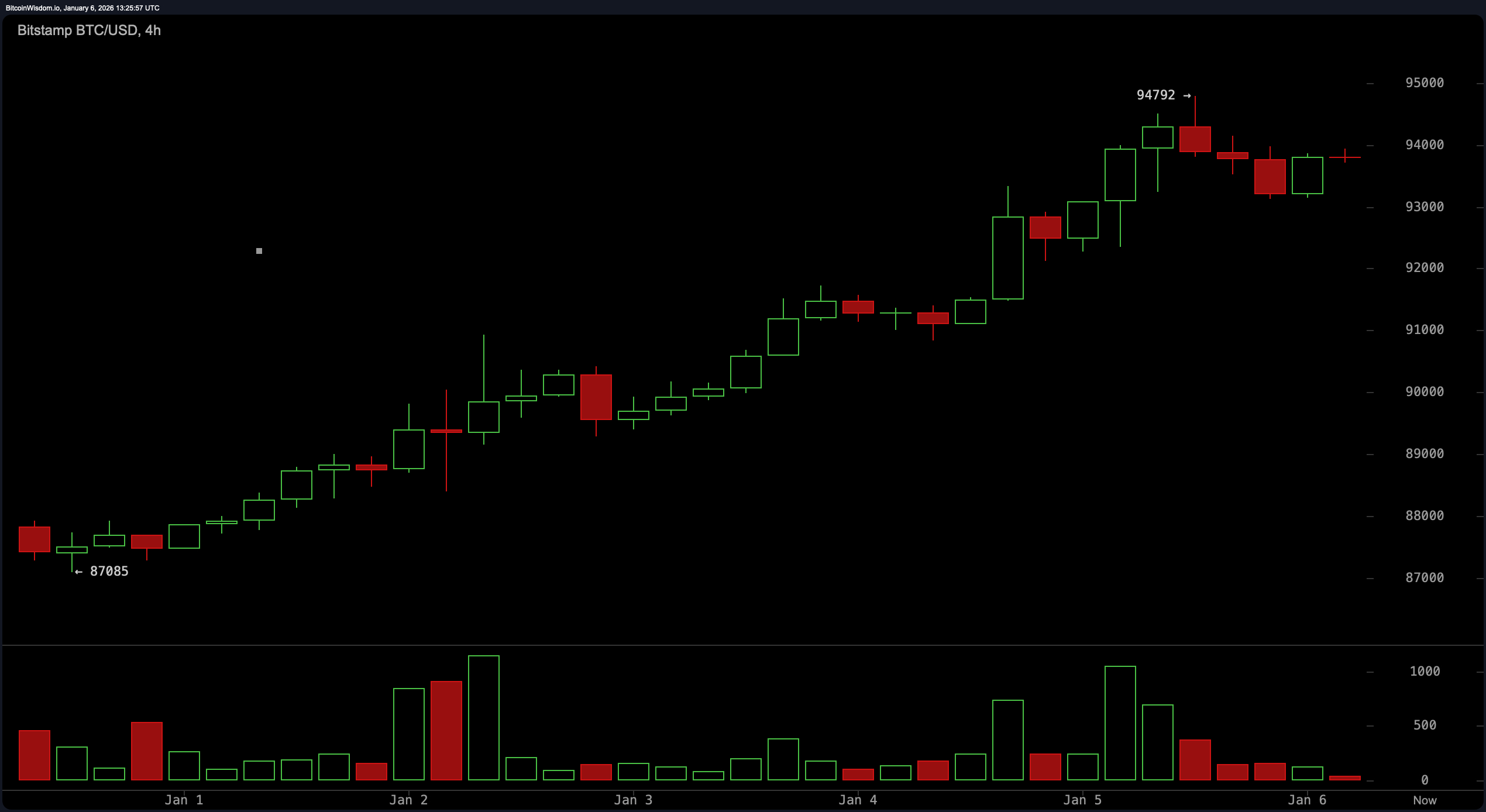

Zooming in on the 4-hour chart, momentum may have cooled, but it hasn’t. Prices rose steadily from $87,000 to $94,800, followed by a gentle decline that was more like a nap than a steep decline. Volume peaked during the breakout and has since declined, suggesting the market is pausing rather than panicking. Bitcoin bullish sentiment will remain in the driver’s seat as long as the $92,500-$93,000 zone persists, and a break above $95,000 could ignite price action. But once the price drops below $92,000, the mood could change dramatically.

BTC/USD 4-hour chart via Bitstamp on January 6, 2026.

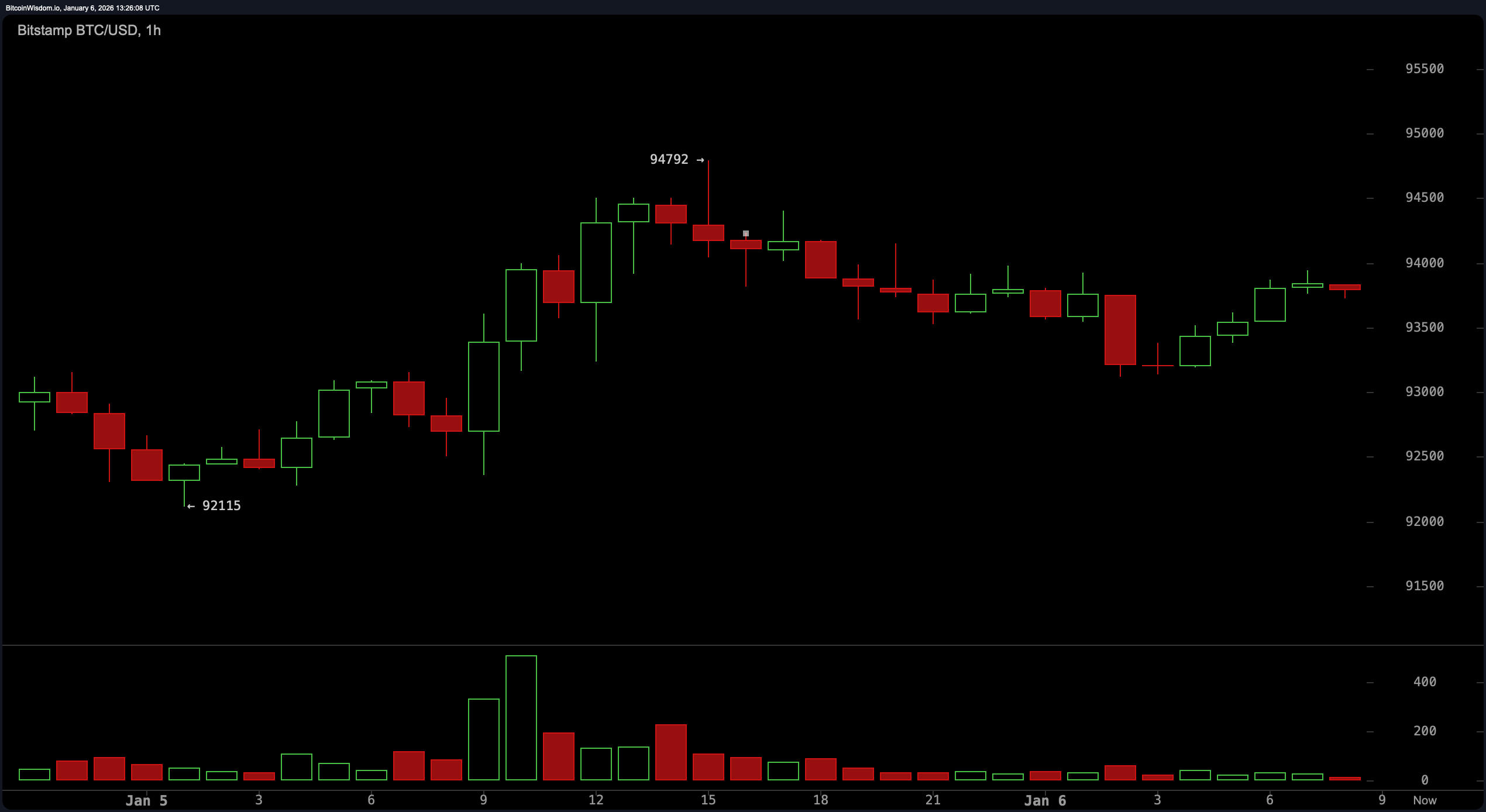

On the other hand, the hourly chart provides a glimpse of the virtual currency chess match unfolding in real time. Bitcoin is trading between $93,000 and $94,800, a narrow enough range to rattle scalpers. Short-term support around $93,000 remains sticky, and the shallow nature of the recent decline suggests sellers are more cautious than committed. A break above $94,800 could put some wind back in the bulls’ sails, while a clean break below $93,000 could send the price up to $92,000. For now, Price remains embroiled in a sideways mess, waiting for a guilty verdict to emerge.

BTC/USD 1 hour chart via Bitstamp on January 6, 2026.

In terms of technical indicators, the situation is a little more complicated. The Relative Strength Index (RSI) is neither overbought nor oversold, hovering at a neutral 65, while the Stochastic Oscillator remains high at 91, but with no directional bias yet. The Commodity Channel Index (CCI) at 225 and the Momentum Indicator at 5,961 are both bearish, suggesting underlying depletion. However, the MACD (Moving Average Convergence Divergence) shows a bullish signal at 587, throwing a curveball into the mix. Think of it as a mixed-signal cocktail, some sweet and some sour.

Moving averages (MAs) support current trends, but with a twist. Short-to-medium term averages such as 10, 20, 30, and 50 period exponential moving averages (EMAs) and simple moving averages (SMAs) are rising in bullish pace. However, the 100 and 200 period moving averages are showing bearish signs, reminding everyone that the big picture is still not clear. With a 200-period simple moving average sitting at a fairly high level of $106,599, Bitcoin’s current price still looks like it’s auditioning for the heavyweight title. But don’t get me wrong. As long as the price continues to break above the critical $92,000 level and make new lows, this market will play an offensive rather than a defensive role.

Bullish verdict:

As long as Bitcoin remains above the $92,000 threshold and maintains its high-to-low trajectory, the bulls will continue to be in control. A tight consolidation below resistance suggests accumulation rather than distribution, and a decisive push above $95,000 could send the next leg higher with renewed momentum.

Bear verdict:

If Bitcoin is unable to defend $93,000 and breaks above $92,000 with volume, it will be ready for a deeper retrace towards structural support near $90,000 and possibly $88,000. Bearish pressure from long-term moving averages and an overstretched oscillator suggests that the upside may already be stalling.

FAQ

- Where is Bitcoin traded today? Bitcoin is trading near $93,788, stabilizing near a major resistance level.

- What is Bitcoin’s current support level?Instant support is $92,000 to $93,000.

- Is Bitcoin showing bullish or bearish signs? Bitcoin is still trending up, but is facing a loss of momentum.

- What supports the Bitcoin price breakout?A clean move above $95,000 would indicate bullish continuation.